Preparing for APRA CPS 230

Key provisions and implementation strategies for enhanced risk management and resilience.

Adoption, migration, optimisation, security and management services designed to deliver business agility.

Improve your security posture with tailored strategies and front-line defence services.

Scalable colocation and connectivity within a hyper secure environment.

Disaster recovery and serviced offices in secure, premium office facilities.

Tailored end-to-end solutions for your hardware ecosystem across the widest range of vendors.

Seamless management of your IT environment, underpinned by world-class cyber security, no matter where you are on your journey.

Securely and effectively operate, monitor and maintain your network.

Enjoy the comfort of a modern working space supported by world class technology, security and resilience.

Help your clients take control of their IT environment with Australia and New Zealand’s leading hardware maintenance provider.

Interactive Anywhere provides robust infrastructure solutions designed to support the seamless operation of digital environments. These solutions include scalable cloud services, reliable data storage, and efficient server management, ensuring optimal performance and uptime.

The network solutions from Interactive Anywhere encompass comprehensive design, implementation, and maintenance of secure and efficient networks. By optimising connectivity and bandwidth, these solutions facilitate seamless communication and data transfer, enhancing overall productivity and operational efficiency.

Interactive Anywhere offers dedicated end user support services that ensure users receive prompt assistance with technical issues. This includes help desk support, troubleshooting, and training, aimed at improving user experience and minimising downtime for businesses.

With a focus on safeguarding digital assets, Interactive Anywhere's cyber security solutions provide advanced protection against cyber threats. These solutions include threat detection, risk management, and compliance services, ensuring businesses can operate securely and with confidence.

Interactive offers financial institutions with secure operations, robust cyber security, seamless connectivity, end-user support, and cloud solutions, ensuring long-term resilience.

For manufacturing, precision and efficiency are paramount. Our solutions optimise operations, streamline processes, and ensure seamless connectivity to drive productivity and innovation.

In professional services, reliability and agility are crucial. Our solutions enhance efficiency, streamline workflows, and provide seamless connectivity, empowering firms to deliver exceptional client experiences and stay ahead in a dynamic market.

In aged care, precision and patient well-being are fundamental. Our solutions enhance operational efficiency, streamline workflows, and guarantee secure, seamless connectivity, empowering providers to deliver exceptional care and lead in an ever-evolving sector.

News & insights from our experts to help you drive performance and grow your business

Case studies of some of our successful collaborations with our customers and partners.

News & insights from our experts to help you drive performance and grow your business

Explore our in-depth whitepapers—strategic insights and practical solutions for smarter decision-making.

Explore expert-led insights on cloud, cybersecurity, and IT trends—actionable guidance from industry leaders.

Enterprise definitions of IT terms used across Interactive services.

We're Australia's leading IT service provider and we keep technology human.

We're Australia's leading IT service provider and we keep technology human.

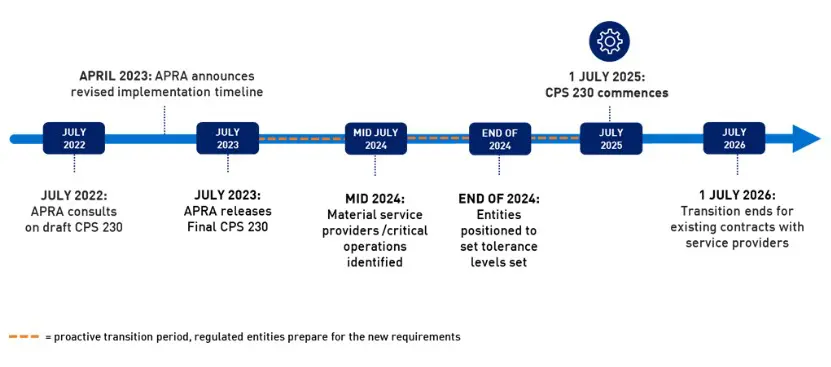

In the ever-evolving landscape of financial regulations, staying ahead of the curve is paramount. In the wake of high-profile operational risk failures and business disruptions, the need for robust risk management practices has never been more pronounced for Australian businesses at large.

The introduction of APRA’s Prudential Standard CPS 230 Operational Risk Management is pivotal for APRA-governed organisations. The upcoming changes outlined in the guideline signifies a greater focus on enhancing the overall business resilience of APRA regulated organisations.

The guideline provides a framework to strengthen operational risk management by addressing identified weaknesses in existing practices, improve business continuity planning to mitigate severe disruptions, and enhance third-party risk management.

As organisations brace for these changes, understanding the key provisions and preparing for implementation are critical steps in ensuring compliance and resilience.

It is clear the updated CPS 230 introduces several significant changes for APRA-regulated entities. Firstly, it outlines the need for detailed requirements for operational risk governance and management, for a robust and comprehensive approach.

Secondly, there’s a notable emphasis on real-time understanding of operational risk profiles, highlighting the importance of staying proactive and vigilant.

Thirdly, senior management is now entrusted with end-to-end responsibility for operational risk, underlining the critical role leadership plays in risk management. In the draft CPS 230, APRA noted that one of its key objectives is to focus the Board on the importance of operational resilience through requiring the setting of tolerance levels for disruptions to critical operations.

Also, there’s a shift from a ‘recovery’ focus to operating through a crisis in real-time, reflecting the evolving nature of risk management practices. Additionally, there’s increased scrutiny on vendor relationships and agreements, underscoring the significance of third-party risk management.

The APRA CPS 230 will replace:

• Prudential Standard CPS 231 Outsourcing (CPS 231)

• Prudential Standard CPS 232 Business Continuity Management (CPS 232)

• Prudential Standard SPS 231 Outsourcing (SPS 231)

• Prudential Standard SPS 232 Business Continuity Management (SPS 232)

• Prudential Standard HPS 231 Outsourcing (HPS 231)

Source: Response paper – Operational Risk Management | APRA

The implications of CPS 230 for APRA-regulated entities and their boards, could be profound for some organisations.

To adhere to the guideline, at a high-level, organisations will need to:

• Develop and maintain risk management frameworks.

• Enhance board governance and set clear parameters to control operational risks.

• Improve existing business continuity management.

• Uplift agreements with service providers.

As organisations gear up for CPS 230 implementation, several steps can facilitate a smooth transition and ensure compliance:

1. Assess current practices: Conduct a comprehensive assessment of existing operational risk management, business continuity planning, and third-party risk management practices. Identify gaps and areas for improvement in alignment with CPS 230 requirements.

2. Develop an implementation plan: Develop a detailed implementation plan outlining tasks, timelines, and responsibilities for achieving compliance with CPS 230. Allocate resources and establish clear communication channels to streamline the implementation process.

3. Engage with stakeholders: Foster collaboration and engagement with key stakeholders, including board members, senior management, and relevant departments. Ensure buy-in and alignment with CPS 230 objectives to facilitate a cohesive approach to compliance.

4. Conduct training and awareness programs: Conduct training sessions and awareness programs to educate employees on CPS 230 requirements, their roles, and responsibilities in compliance, and the importance of robust risk management practices.

5. Strengthen your vendor relationships: Uplift contracts with material service providers to meet CPS 230 requirements, and have clear service provider management policy in place.

Interactive’s tailored solutions are key to the overall resilience posture of our clients. Our suite of Business Continuity, Disaster Recovery, Cyber Security and Back-Up services, paired with our collaborative approach to engagement provides our customers with the expertise to proactively prepare for CPS 230 implementation, ensuring regulatory compliance and operational resilience.

A leader in Business Continuity & Disaster Recovery: With 35 years of experience, Interactive stands as a leader in business continuity solutions. From rapid recovery to resilient, premium facilities, we ensure minimal downtime and maximum compliance.

Learn how to mitigate risk to your business when its most vulnerable with our free business continuity plan template.

Contact us to find out more.

With our history of supporting APRA customers, we can help you adhere to CPS320 & 234 by end of June.

We use cookies to enhance your experience, analyse site traffic, and personalise content and ads. By clicking 'Accept,' you agree to our use of cookies. For more details, please view our Privacy Policy.